Linde Reports Strong Q2 2025 Results

NETC Contributes to Sustainable Development of the Global Gas Industry

Linde plc announced its second-quarter 2025 results on August 1, 2025, demonstrating robust overall performance.

According to the report, Linde's second-quarter net income was $1.766 billion, with diluted earnings per share (EPS) of $3.73, representing year-over-year increases of 6% and 8%, respectively. Excluding acquisition accounting impacts, adjusted net income was $1.937 billion, up 4% year-over-year, and adjusted EPS was $4.09, an increase of 6%.

Linde's second-quarter sales reached $8.495 billion, a 3% increase compared to the prior-year quarter. Underlying sales grew 1%, with price increases contributing 2%, partially offset by a 1% volume decline primarily driven by manufacturing end markets. Operating profit was $2.354 billion, while adjusted operating profit was $2.556 billion, rising 6% year-over-year. This growth was attributed to price increases across all segments and ongoing productivity initiatives. The adjusted operating profit margin was 30.1%, an 80 basis point improvement over the prior year.

Regarding cash flow, Linde generated operating cash flow of $2.211 billion in the second quarter, a 15% year-over-year increase. After capital expenditures of $1.257 billion, free cash flow was $954 million. Additionally, the company returned $1.811 billion to shareholders through dividends and net share repurchases.

Sanjiv Lamba, Chief Executive Officer of Linde, stated: "Linde once again demonstrated strong resilience, and our people delivered high-quality results." He highlighted that higher pricing and operational improvements were key factors in the company's performance. Furthermore, Linde signed several new contracts, including a long-term agreement to supply gases to a low-carbon ammonia plant on the U.S. Gulf Coast, which is part of Linde's $7.1 billion gas sales backlog. Lamba added: "The current $7.1 billion gas sales backlog will ensure considerable growth for the years ahead, and I am confident in our ability to add more high-quality projects, particularly in the electronics and clean energy end markets."

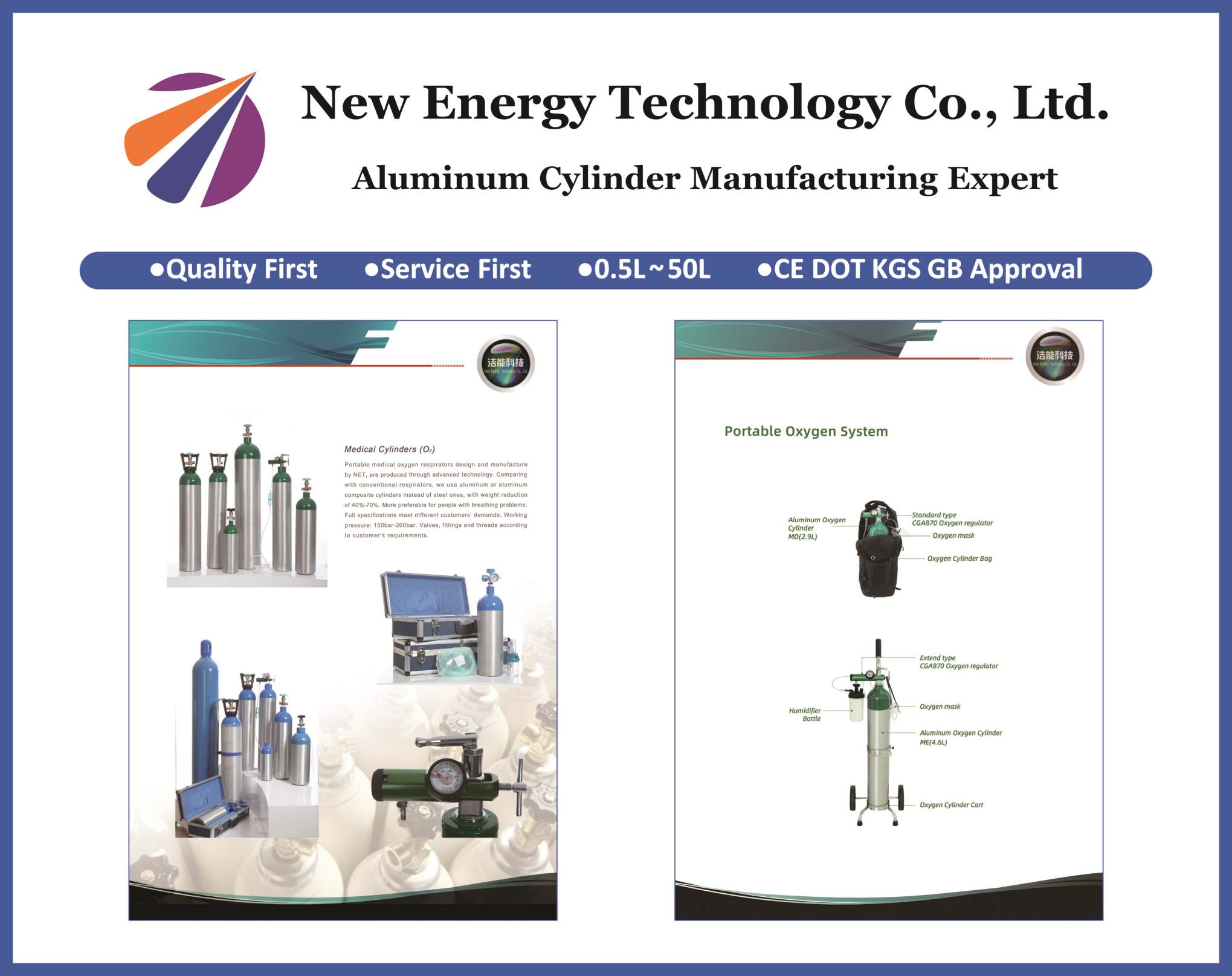

As a vital link in the gas industry supply chain, China's high-end manufacturer NETC, leveraging its special inner wall treatment process for aluminum gas cylinders, is providing critical infrastructure support across multiple sectors including industrial gases, electronic specialty gases, and medical gases.

Regional Performance Breakdown:

Americas: Sales increased 4% to $3.81 billion, driven by higher pricing and volumes in the chemicals and energy markets. Operating profit remained stable at $1.2 billion.

Asia Pacific (APAC): Sales were flat at $1.65 billion. Despite lower manufacturing output, operating profit grew 1% to $490 million, with the operating margin improving to 29.6%.

Europe, Middle East & Africa (EMEA): Sales grew 3% to $2.16 billion, despite a 1% decline in underlying sales. Operating profit increased by 240 basis points to $780 million.

Linde Engineering: Sales increased 1% to $551 million, with operating profit of $90 million. Order intake for the quarter was $311 million, and the third-party sale of equipment backlog stood at $3.2 billion.

NETC, as a highly internationalized manufacturer of aluminum gas cylinders, offers a comprehensive product portfolio including Medical aluminum gas cylinders, Industrial aluminum gas cylinders, and Beverage CO2 aluminum cylinders. By providing lightweight, corrosion-resistant, and rust-proof high-pressure vessels, NETC delivers robust assurance for the safe storage and transportation of industrial standard gases, industrial high-purity gases, electronic specialty gases, medical gases, and beverage-grade gases globally.

Looking ahead, Linde expects third-quarter 2025 adjusted EPS to be in the range of $4.10 to $4.20, representing growth of 4% to 7% year-over-year, or 3% to 6% excluding foreign exchange impacts. The full-year 2025 adjusted EPS guidance remains unchanged at $16.30 to $16.50. Linde stated: "For the second half of 2025, we will maintain a more cautious view of potential macro trends. However, regardless of the economic outlook, we will continue to create long-term shareholder value."

NETC: Advanced Representative and Sincere Partner in the Aluminum Gas Cylinder Industry

As an advanced representative in the aluminum gas cylinder industry and a sincere partner to the global gas industry, NETC's product lines deeply cover industrial chain demands:

Medical Field: Supplies Medical aluminum cylinders compliant with DOT 3AL and CE ISO 7866 standards. Specifications include 1L to 50L, D/E size (2.8L to 4.6L), M60/M90 (10L/15.7L), M122/M150 (20L to 30L), M265 (40L/46.4L), as well as specialized medical gas containers such as N2O cylinders, MRI aluminum cylinders, and Nitric oxide cylinders.

Industrial Field: Manufactures Industrial aluminum cylinders suitable for standard gases, high purity gases, electronic specialty gases, and calibration gases. Capacities range from 1L, 2L, 3L, 4L, 5L, 8L, 10L, 20L, 28.9L, 29.5L, 30L, 40L, 50L, as well as 46.4L and 47.5L. Working pressure reaches 200Bar, meeting CE ISO 7866 and DOT certification requirements.

Emerging & Niche Fields: Provides Beverage CO2 aluminum cylinders (e.g., 5lb, 9.1kg/20lb, 10kg, 50lb), Diving aluminum cylinders (SCUBA tanks) (e.g., S80, 11.1L), Fire extinguisher aluminum cylinders, and Special treatment aluminum cylinders featuring specialized inner wall processes. These are used for containing corrosive gases (e.g., H2S, SO2, NH3, HCl, NO2, NOX, CO) and ultra high purity electronic gases.